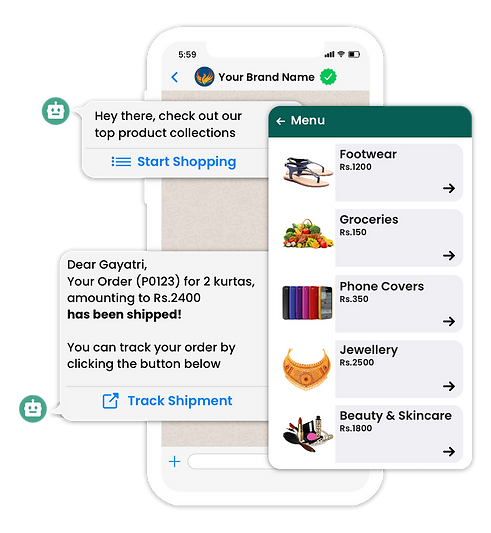

WhatsApp Pay for Business is a feature that allows businesses to receive payments directly through WhatsApp. Here are some benefits:

- Convenience: Businesses can receive payments from customers directly through WhatsApp, making the payment process more convenient for both parties.

- Integration: WhatsApp Pay can be integrated seamlessly into existing business communication on WhatsApp, allowing for a smooth transaction process without the need for additional platforms or apps.

- Increased Sales: Offering a convenient payment option like WhatsApp Pay can potentially lead to increased sales as customers may be more inclined to make purchases if the payment process is easy and familiar.

- Cost-Effective: WhatsApp Pay transactions typically have lower fees compared to other payment methods, which can save businesses money on transaction fees.

- Customer Engagement: Using WhatsApp Pay can enhance customer engagement as businesses can interact with customers and process transactions all within the same platform, fostering stronger relationships.

- Security: WhatsApp Pay transactions are secured with end-to-end encryption, providing a secure payment environment for both businesses and customers.

- Data Insights: WhatsApp Pay for Business may offer data insights and analytics, allowing businesses to better understand customer behavior and preferences, which can inform future business decisions and strategies.

Overall, WhatsApp Pay for Business can streamline the payment process, improve customer satisfaction, and potentially boost sales for businesses.

WhatsApp Pay typically supports various payment methods depending on the region and partnerships with financial institutions. Some common payment methods supported by WhatsApp Pay include:

- Bank Transfers: Users can link their bank accounts to WhatsApp Pay and transfer money directly from their bank account to another user’s bank account.

- Debit Cards: Users may be able to link their debit cards to WhatsApp Pay to make payments directly from their linked bank account.

- UPI (Unified Payments Interface): In regions like India, WhatsApp Pay supports UPI payments, allowing users to link their bank accounts and make payments using UPI IDs or QR codes.

- Credit Cards: Depending on partnerships and availability, users may also be able to link their credit cards to WhatsApp Pay to make payments.

- Wallets: Some regions may support digital wallets integration, allowing users to make payments using wallet balances linked to their WhatsApp account.

It’s essential to note that the availability of these payment methods may vary depending on the country or region and the partnerships WhatsApp has established with local financial institutions and payment service providers.